In tackling the complexities of the Irish tax system, grasping its intricacies can significantly influence your business’s profitability and compliance. As you seek to navigate Irish business tax for success, understanding the system’s structure is paramount. Ireland’s tax regime offers opportunities through its comparatively low corporate tax rate, which stands as one of the most attractive in Europe. However, it’s essential to keep abreast of the regulations to ensure you are optimising your tax position without falling foul of the rules.

Your business will encounter various tax considerations, from VAT obligations to the implications of transfer pricing. The Ireland Revenue Commissioners, the body responsible for tax and customs, are actively refining their systems to clamp down on evasion and maximise efficiency. Keeping up with these changes is essential; this way, you can mitigate any risks of non-compliance that could lead to penalties.

By staying informed and proactive about your tax responsibilities, your business can benefit from the favourable aspects of Ireland’s tax environment. Ensure you maintain clear records and seek professional advice where necessary. A strategic approach to your tax affairs can not only ensure compliance with Irish tax laws but also enhance your business’s potential for growth and success on the Emerald Isle.

Overview of Ireland’s Tax System

Your understanding of Ireland’s tax system is crucial to making informed decisions about your business. This section will provide you with some historical insights, explain the current tax landscape, and offer comparisons with EU and OECD standards.

Historical Context and Milestones

In 1997, Ireland introduced significant changes to its tax regime, which became a milestone in shaping the modern Irish economy. This included lowering corporate tax rates to appeal to international investors. Since then, Ireland’s tax system has undergone continuous reforms to comply with global standards while maintaining its competitiveness.

Current Tax Landscape in Ireland

Ireland’s current tax landscape is characterised by a corporate tax rate that is one of the lowest in Europe at 12.5%. This rate applies to trading income, while non-trading income is taxed at 25%. As an individual taxpayer, you would encounter different rates of income tax, Universal Social Charge (USC), and Pay Related Social Insurance (PRSI) depending on your income level. VAT rates in Ireland are also important to note, with the standard rate set at 23%, although reduced rates apply to certain goods and services.

Comparing Ireland to EU and OECD Standards

When comparing the Irish tax system to European Union (EU) and Organisation for Economic Co-operation and Development (OECD) standards, you’ll notice that Ireland maintains its edge with its low corporate tax rate. However, as a member of the EU and the OECD, Ireland has committed to global initiatives to prevent tax evasion. This includes implementing measures from the OECD’s Base Erosion and Profit Shifting (BEPS) project. The ongoing cooperation with the EU and OECD ensures that Ireland’s tax regime continues to evolve in step with international standards.

Corporate Taxation in Ireland

Your understanding of Ireland’s corporate tax system is crucial to maximising the benefits for your business. It’s known for its favourable conditions, especially for multinationals, and it’s important you familiarise yourself with aspects such as the corporation tax system, how profits are taxed, participation exemptions on dividends, and available tax incentives.

Corporation Tax System Explained

In Ireland, your company will be subjected to corporation tax on its profits, which includes both income and chargeable gains. If your company is resident in Ireland, it will be taxed on its worldwide profits. However, non-resident companies that conduct business through a branch or agency are only taxed on the profits from their Irish operations.

Profit Calculation and Tax Rates

The standard rate of corporation tax on trading income is 12.5%, one of the lowest in the European Union, which is particularly appealing if you’re running a multinational enterprise. For non-trading income, such as investment income and rental income, the rate is 25%. Your company’s taxable profits are calculated after deducting trading expenses, certain capital allowances, and losses from previous years.

Participation Exemption and Dividends

Your business may benefit from participation exemption on dividends received from other resident companies. This means that dividends paid by one Irish resident company to another are often exempt from taxation. Also, dividends received from certain foreign subsidiaries can be exempt, provided those subsidiaries are subject to a tax similar to the Irish corporation tax and are not engaged in certain activities.

Tax Incentives for Multinationals

Ireland offers several tax incentives for multinationals to establish their presence within the country. Your business could take advantage of the Research and Development (R&D) tax credit which is 25% of qualifying expenditure. Ireland also has a regime known as the Knowledge Development Box (KDB), which applies a 6.25% tax rate to profits derived from qualifying R&D activities. These incentives are designed to promote innovation and development, making Ireland an attractive location for high-tech industries.

Tax Planning Strategies

When you’re looking to optimise your tax situation in Ireland, thorough planning is essential. You have several avenues through which you can potentially reduce your effective tax rate and utilise various credits and reliefs, which can significantly impact your business’s financial health.

Effective Tax Rate Optimisation

Your effective tax rate is the average rate at which your company’s pre-tax earnings are taxed. One strategy to manage this rate is through the timing of income and expenses; by accelerating certain expenses or deferring income, you may lower your tax liability in a given financial year. It is also important to consider how your business structure—whether you’re operating as a sole trader, a partnership, or a limited company—can influence your effective tax rate. Companies like Kinore Ireland can provide indispensable advice in structuring your business to achieve optimal tax efficiency.

Utilising Credits and Reliefs

You have the opportunity to reduce your overall tax bill by capitalising on various credits and reliefs offered by the Irish tax system. Be proactive in claiming the R&D credit if your business invests in innovative projects, as it can provide a significant reduction in your corporation tax. Furthermore, the Employment Investment Incentive can offer relief if you’re acquiring new shares in a company. Understanding the nuances of tax credit rules is key, and seeking professional guidance ensures you don’t overlook any benefits you’re entitled to.

International Tax Planning Considerations

If your business operates across borders, it’s vital to navigate international tax treaties and regulations wisely to avoid double taxation and ensure compliance. Consider how transfer pricing affects your taxation and the advantages of establishing operations in special economic zones that offer favourable tax conditions.

Legal and Regulatory Framework

Ireland’s tax system is defined by a robust legal and regulatory framework tailored to be business-friendly while ensuring compliance with international obligations. The intricacies of this framework are essential for your business to thrive in Ireland’s economic landscape.

Finance Bill and Tax Legislation

Each year, the Finance Bill is introduced by the Minister for Finance to implement tax changes announced during the Budget speech. This Bill affects how your business will operate financially, as it details amendments to existing tax laws and introduces new ones. It’s crucial for you to stay updated with these changes, as they can impact everything from corporate tax rates to tax reliefs available to your business.

Department of Finance and IDA’s Role

The Department of Finance is your go-to source for understanding the policy decisions that shape Ireland’s tax environment. Working alongside the Investment and Development Agency (IDA), they create incentives to attract and retain businesses like yours in Ireland. The IDA offers support and guidance, ensuring you gain the full benefits of the country’s tax incentives for research, development, and innovation.

Compliance with State Aid Rules

Staying compliant with State Aid Rules is a must for your business. These European Union regulations ensure fair competition and that Government supports, including tax breaks or incentives, are not giving an advantage in a way that distorts competition. Your business must adhere to these rules, which are monitored by the European Commission, to maintain its operations within Ireland and the broader EU market.

International Taxation and Ireland

Ireland’s tax system can be quite beneficial for your business, especially with its stance on international taxation that aligns with both EU mandates and OECD guidelines. Understanding how these regulations affect your business operations can give you a competitive edge.

Impact of OECD and EU Directives

You’ll find that Ireland fully complies with directives from both the Organisation for Economic Co-operation and Development (OECD) and the European Union (EU). They have implemented the Anti-Tax Avoidance Directives (ATAD) which aim to prevent tax avoidance practices that directly affect the functioning of the internal market. This means your business must adhere to rules on controlled foreign companies (CFC) and limits on interest deductions to ensure a fair and consistent tax policy across the EU.

Ireland’s Position on Global Tax Reforms

Ireland actively participates in the global discussions on tax reforms and has shown a willingness to support initiatives that strive for transparency and fair tax competition. Recent reforms underline Ireland’s commitment to consistent application of tax rules, curbing harmful tax practices and ensuring your business pays tax where economic activities occur.

Pillar Two and the Global Minimum Tax Directive

The implementation of Pillar Two refers to the two-pillar solution to address the tax challenges arising from the digitalisation of the economy. For your business, this includes adherence to the Global Minimum Tax Directive, orchestrated by the OECD. A key component of Pillar Two is the global minimum corporate tax rate, which has been set at 15%. Your business operations in Ireland could be impacted by this, particularly if your profits were previously taxed at a lower rate.

When you manage your business in Ireland, these international tax policies should be carefully considered in your financial planning and compliance efforts.

Business Implications of Tax Policies

Ireland’s tax system can play a significant role in your business strategy, whether you’re an investor seeking opportunities, a business owner focusing on growth or a manager dealing with the compliance aspects of taxation on the island. Here’s what you need to know about how these policies might affect different aspects of your business.

Investment and Investor Perspective

Your investors are keenly interested in the corporate tax rate, which, in Ireland, is famously competitive. This low rate can significantly enhance the return on investment by minimising the amount of profits you’ll owe to the government. However, it’s crucial to stay informed about changes in tax policies, as these can affect the attractiveness of Ireland to both domestic and foreign investors.

Employment and Economic Contributions

When you generate employment in Ireland, you’re contributing to the economy not just through the creation of jobs, but also through the payment of Pay As You Earn (PAYE) taxes and social security on behalf of your employees. This is beneficial for your public relations, but it also increases the payroll administrative tasks you need to manage.

Administrative and Compliance Burden

Managing your tax affairs is no small feat in Ireland or anywhere else. The administrative and compliance burden can be considerable, especially if you’re unfamiliar with the requirements. You’ll need to ensure your finances are in order, returns are accurately filed on time, and you’re keeping abreast of any legislative changes – all of which can be time-consuming activities but are vitally important to avoid penalties and keep your business running smoothly. Your careful attention to tax compliance supports the integrity of your business operations and contributes to your reputation as a responsible business entity.

Future Trends and Policy Proposals

Understanding upcoming shifts in Ireland’s tax landscape and proposed policy reforms will help you align your business strategies effectively.

Anticipating Changes in Taxation

Keeping abreast of potential tax changes is critical for your business planning. You may see alterations reflecting global economic trends, such as shifts in corporation tax in response to international consensus. The focus is often on maintaining a competitive edge while ensuring fairness and transparency in the tax system. These discussions are closely tied to broader economic developments, including the evolving regulatory frameworks and digital innovations shaping the future of banking in Ireland, which may influence both access to finance and how tax policies are structured to support modern financial services.

Ongoing Consultation and Public Input

Your opinion matters. Regular consultations provide you with a chance to contribute to tax policy discussions. The government invites stakeholders including business owners, tax professionals, and the general public to voice their thoughts, which can shape forthcoming proposals and reform plans.

Minister for Finance’s Proposals

Stay informed about proposals from the Minister for Finance, such as Michael McGrath, who shapes Ireland’s fiscal policy. These proposals, often presented in the Budget, affect your company’s tax liabilities. They can include changes to credits, reliefs, and rates that may impact the exchequer and, consequently, your business.

Conclusion

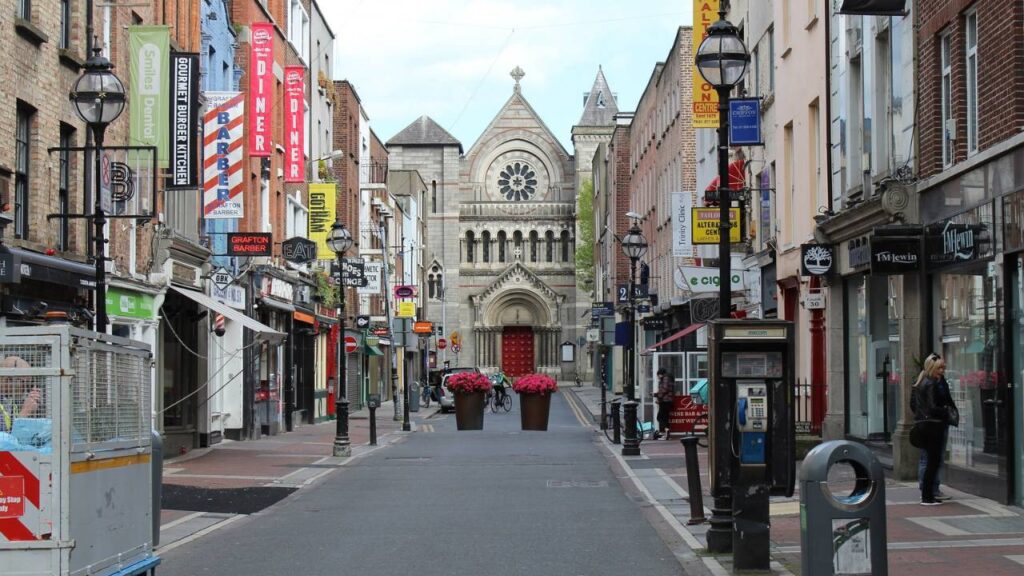

Your journey in navigating Ireland’s tax landscape can significantly influence the financial health of your company. If setting up a business in Dublin, for instance, becoming familiar with the corporate tax rate of 12.5%, which is one of the lowest in Europe, is advantageous. Knowing that there are tax reliefs such as the Research and Development (R&D) tax credits, which can reduce your tax liability, is key.

Keep in mind that Ireland’s approach to taxation is designed to encourage entrepreneurship. As such, the Start-up Refunds for Entrepreneurs (SURE) scheme or the Employment and Investment Incentive (EII) could be beneficial for your business. Moreover, value-added tax (VAT) rules should be well understood, as they affect both your pricing strategies and compliance requirements.

The double taxation agreements Ireland has with many countries can prevent you from being taxed twice on the same income. It’s prudent to consult with a tax professional who can provide tailored advice, ensuring that your business remains compliant while optimising tax efficiency. This understanding can give your business a solid foundation as you expand in the Irish market and beyond.